Tough Stance Sparks Backlash: Growing Wariness for Belt and Road Initiative

Related Articles

Belt and Road Expansionist Policy Reaches Turning Point; Diplomatic Offensive to Join TPP

A quarter of the low-to-middle-income countries (LMICs) receiving loans related to the Belt and Road Initiative (BRI) have debt exposure to China exceeding 10% of their GDP. The shocking report was released in late September and at once reported across the world by mainstream media.

The study was conducted by AidData, a U.S.-based private research lab. AidData examined approximately 13,400 BRI projects in 165 countries in Asia, Africa, and other world regions between 2000 and 2017, financed by Chinese government institutions and state-owned entities. The total lending by China exceeded 843 billion USD, with 385 billion USD as “hidden debt” that went unreported as government liabilities. In 42 countries, the Chinese debt exposure exceeded 10% of their GDP.

Since 2010, China has merely released white papers on foreign support several times and revealed little about its actual situation. AidData estimates the outstanding debt of LMICs from Chinese loans are substantially larger than previously understood abroad.

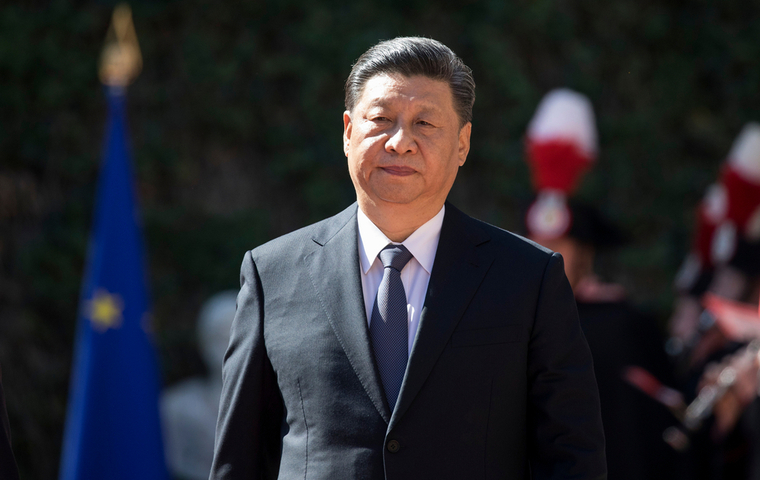

The BRI is the core foreign policy launched in September 2013 by Xi Jinping, a year after he became the General Secretary of the Chinese Communist Party, the top government position. At the time, the U.S. Obama administration had declared “Rebalance to Asia,” leading the Trans-Pacific Partnership (TPP) negotiations on the economic side, while clearly strengthening military cooperation with Asia-Pacific allies including Japan and Australia on the security side.

Relations with China had become tense over the Senkaku Islands for Japan, and over South China Sea territorial issues for the Southeast Asian countries. As pressures from the east side intensified, Xi Jinping attempted to seek a way out in the west side and pictured a grandiose plan to create an economic zone spanning from Central Asia to Europe and across Middle East and Africa.

Laos in Deepest Debt

From 2015, two years after announcing the BRI, China accelerated its financial support towards LMICs for infrastructure construction such as railroads, highways, and ports. Yet many of these projects had doubtful profitability. In 2018, the International Monetary Fund (IMF) pointed out that heavily indebted poor countries in Africa cannot repay their debts to China. It was around this time that criticism arose on the “debt trap” diplomacy—saddling a country with unsustainable loans and gain infrastructure concessions in exchange for debt relief.

The AidData study served as a renewed warning on the risks behind China’s expansionist policy. In the study, Laos had the largest “hidden debt” as a percentage of GDP. Together with the publicly reported government debt, the country owes China 64% of its GDP. Based on the support from China, Laos plans to open a highway that connects its capital Vientiane with the Chinese border by the end of 2021.

The highway was publicized to extend out to Thailand’s capital Bangkok in the future, yet it seems unfeasible. For Laos, a poorest country, repaying the debt by itself would be difficult, and there are fears that China will take over the project.

Amid concerns of Chinese “debt traps” in Africa and Asia, the G7 leaders at the June 2021 summit agreed on infrastructure support measures for the developing countries. In July, the EU also agreed to come up with a support plan that rivals BRI. If these highly transparent support measures materialize, the developing countries will have more options for economic support.

Meanwhile, if China continues to over invest in disregard of the recipient country’s fiscal management, risk-averse countries will move away from China, and the BRI may reach a deadlock.

Butting in to Avoid Isolation

“We must pay attention to grasp the tone, be both open and confident but also modest and humble, and strive to create a credible, lovable and respectable image of China,” Xi Jingling said at a study meeting in late June, in his request for better external communication, as if aware of the backlash against China’s expansionist policy.

So far, there seems to be no prominent effect from his instructions. But for trade policies, perhaps from fear of isolation, China is starting to show a conciliatory stance. After repeated concessions, China joined the Regional Comprehensive Economic Partnership (RCEP) in East Asia in November 2020, and recently, applied for the TPP membership.

China has been seeking to establish a framework for trade liberalization by creating pilot free trade zones in various regions. Although still not prepared, China seized the opportunity to butt in, since the U.S., which withdraw from the TPP during the Trump era, had not changed its attitude under the Biden administration.

However, the prospect for China’s TPP entry is tough. One of the biggest hurdles is the issue of subsidies to state-owned enterprises. The current Xi Jinping leadership is oriented towards “guo jin min tui”—the state advances, the private sector retreats. The concept places state-owned enterprises, devoted workers for the Communist Party and the government, as the pillars for strengthening industrial competitiveness to counter the U.S.

While pressuring outstanding private companies such as the Alibaba Group with the anti-monopoly law, China is merging large state-owned enterprises in the materials and IT sectors and creating an intensified monopoly. Unless China changes its biased industrial policy, it is impossible to join the TPP, which prohibits preferential treatment of state-owned enterprises that hinder free competition.

When China joined the World Trade Organization (WTO) in 2001, the developed countries hoped China’s inclusion in the global trade and investment framework would change its system to a liberal system like their own. That expectation has now become an illusion, and China is becoming more tyrannical, both domestically and externally.

Around the same time as China, Taiwan also applied to join the TPP. How will these two applications be treated? China has been intensifying its diplomatic offensive against member countries, and some already voice their support for China. If they make the wrong decision out of fear of China’s expansionary policy, it could create a divide within the TPP.

(Kenji Yuasa, Japan Center for Economic Research Lead Economist)